Tutorial: Scorecard with binary target¶

In this tutorial, we use the dataset from the FICO Explainable Machine Learning Challenge: https://community.fico.com/s/explainable-machine-learning-challenge. The goal is to develop a scorecard using the logistic regression as an estimator.

[1]:

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

[2]:

from sklearn.linear_model import LogisticRegression

from optbinning import BinningProcess

from optbinning import Scorecard

from optbinning.scorecard import plot_auc_roc, plot_cap, plot_ks

Download the dataset from the link above and load it.

[3]:

df = pd.read_csv("data/FICO_challenge/heloc_dataset_v1.csv", sep=",")

[4]:

variable_names = list(df.columns[1:])

X = df[variable_names]

Transform the categorical dichotomic target variable into numerical.

[5]:

target = "RiskPerformance"

y = df[target].values

mask = y == "Bad"

y[mask] = 1

y[~mask] = 0

y = y.astype(int)

[6]:

df.head()

[6]:

| RiskPerformance | ExternalRiskEstimate | MSinceOldestTradeOpen | MSinceMostRecentTradeOpen | AverageMInFile | NumSatisfactoryTrades | NumTrades60Ever2DerogPubRec | NumTrades90Ever2DerogPubRec | PercentTradesNeverDelq | MSinceMostRecentDelq | ... | PercentInstallTrades | MSinceMostRecentInqexcl7days | NumInqLast6M | NumInqLast6Mexcl7days | NetFractionRevolvingBurden | NetFractionInstallBurden | NumRevolvingTradesWBalance | NumInstallTradesWBalance | NumBank2NatlTradesWHighUtilization | PercentTradesWBalance | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 55 | 144 | 4 | 84 | 20 | 3 | 0 | 83 | 2 | ... | 43 | 0 | 0 | 0 | 33 | -8 | 8 | 1 | 1 | 69 |

| 1 | 1 | 61 | 58 | 15 | 41 | 2 | 4 | 4 | 100 | -7 | ... | 67 | 0 | 0 | 0 | 0 | -8 | 0 | -8 | -8 | 0 |

| 2 | 1 | 67 | 66 | 5 | 24 | 9 | 0 | 0 | 100 | -7 | ... | 44 | 0 | 4 | 4 | 53 | 66 | 4 | 2 | 1 | 86 |

| 3 | 1 | 66 | 169 | 1 | 73 | 28 | 1 | 1 | 93 | 76 | ... | 57 | 0 | 5 | 4 | 72 | 83 | 6 | 4 | 3 | 91 |

| 4 | 1 | 81 | 333 | 27 | 132 | 12 | 0 | 0 | 100 | -7 | ... | 25 | 0 | 1 | 1 | 51 | 89 | 3 | 1 | 0 | 80 |

5 rows × 24 columns

Scorecard development¶

This dataset includes three special values/codes:

-9 No Bureau Record or No Investigation

-8 No Usable/Valid Trades or Inquiries

-7 Condition not Met (e.g. No Inquiries, No Delinquencies)

[7]:

special_codes = [-9, -8, -7]

We specify a selection criteria in terms of the Information Value (IV) predictiveness and minimum quality score to remove low-quality variables. Then, we instantiate a BinningProcess object class with variable names, special codes and selection criteria.

[8]:

selection_criteria = {

"iv": {"min": 0.02, "max": 1},

"quality_score": {"min": 0.01}

}

[9]:

binning_process = BinningProcess(variable_names, special_codes=special_codes,

selection_criteria=selection_criteria)

We select as an estimator a logistic regression to be solved using the non-linear solver L-BFGS-B.

[10]:

estimator = LogisticRegression(solver="lbfgs")

Finally, we instantiate a Scorecard class with the target name, a binning process object, and an estimator. In addition, we want to apply a scaling method to the scorecard points.

[11]:

scorecard = Scorecard(binning_process=binning_process,

estimator=estimator, scaling_method="min_max",

scaling_method_params={"min": 300, "max": 850})

[12]:

scorecard.fit(X, y, show_digits=4)

/home/gui/projects/github/top/optbinning/optbinning/binning/transformations.py:38: RuntimeWarning: invalid value encountered in log

return np.log((1. / event_rate - 1) * n_event / n_nonevent)

[12]:

Scorecard(binning_process=BinningProcess(selection_criteria={'iv': {'max': 1,

'min': 0.02},

'quality_score': {'min': 0.01}},

special_codes=[-9, -8, -7],

variable_names=['ExternalRiskEstimate',

'MSinceOldestTradeOpen',

'MSinceMostRecentTradeOpen',

'AverageMInFile',

'NumSatisfactoryTrades',

'NumTrades60Ever2DerogPubRec',

'NumTrades90Ever2DerogPubRec',

'PercentTradesNe...

'PercentInstallTrades',

'MSinceMostRecentInqexcl7days',

'NumInqLast6M',

'NumInqLast6Mexcl7days',

'NetFractionRevolvingBurden',

'NetFractionInstallBurden',

'NumRevolvingTradesWBalance',

'NumInstallTradesWBalance',

'NumBank2NatlTradesWHighUtilization',

'PercentTradesWBalance']),

estimator=LogisticRegression(), scaling_method='min_max',

scaling_method_params={'max': 850, 'min': 300})

Similar to other objects in OptBinning, we can print overview information about the options settings, problems statistics, and the number of selected variables after the binning process. With these settings, using the selection criteria, 4 variables are removed.

[13]:

scorecard.information(print_level=2)

optbinning (Version 0.19.0)

Copyright (c) 2019-2024 Guillermo Navas-Palencia, Apache License 2.0

Begin options

binning_process yes * U

estimator yes * U

scaling_method min_max * U

scaling_method_params yes * U

intercept_based False * d

reverse_scorecard False * d

rounding False * d

verbose False * d

End options

Statistics

Number of records 10459

Number of variables 23

Target type binary

Number of numerical 23

Number of categorical 0

Number of selected 19

Timing

Total time 3.28 sec

Binning process 2.62 sec ( 79.92%)

Estimator 0.25 sec ( 7.70%)

Build scorecard 0.41 sec ( 12.36%)

rounding 0.00 sec ( 0.00%)

The method table returns the scorecard table. A scorecard table has a wide range of real-world business applications, being an interpretable tool to summarize relationships among variables. The scorecard table can handle binary and continuous targets. Two scorecard styles are available: style="summary" shows the variable name, and their corresponding bins and assigned points; style="detailed" adds information from the corresponding binning table.

[14]:

scorecard.table(style="summary")

[14]:

| Variable | Bin | Points | |

|---|---|---|---|

| 0 | ExternalRiskEstimate | (-inf, 59.5000) | 5.359275 |

| 1 | ExternalRiskEstimate | [59.5000, 63.5000) | 11.598078 |

| 2 | ExternalRiskEstimate | [63.5000, 65.5000) | 18.168973 |

| 3 | ExternalRiskEstimate | [65.5000, 67.5000) | 19.821705 |

| 4 | ExternalRiskEstimate | [67.5000, 70.5000) | 25.498720 |

| ... | ... | ... | ... |

| 8 | PercentTradesWBalance | [80.5000, 87.5000) | 32.310289 |

| 9 | PercentTradesWBalance | [87.5000, 98.0000) | 32.026880 |

| 10 | PercentTradesWBalance | [98.0000, inf) | 31.928758 |

| 11 | PercentTradesWBalance | Special | 32.738612 |

| 12 | PercentTradesWBalance | Missing | 32.738612 |

164 rows × 3 columns

[15]:

scorecard.table(style="detailed")

[15]:

| Variable | Bin id | Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | Coefficient | Points | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | ExternalRiskEstimate | 0 | (-inf, 59.5000) | 1081 | 0.103356 | 166 | 915 | 0.846438 | -1.619109 | 0.217629 | 0.024574 | -0.327969 | 5.359275 |

| 1 | ExternalRiskEstimate | 1 | [59.5000, 63.5000) | 1097 | 0.104886 | 228 | 869 | 0.792160 | -1.250170 | 0.142003 | 0.016678 | -0.327969 | 11.598078 |

| 2 | ExternalRiskEstimate | 2 | [63.5000, 65.5000) | 681 | 0.065111 | 190 | 491 | 0.720999 | -0.861592 | 0.044754 | 0.005427 | -0.327969 | 18.168973 |

| 3 | ExternalRiskEstimate | 3 | [65.5000, 67.5000) | 652 | 0.062339 | 195 | 457 | 0.700920 | -0.763856 | 0.034156 | 0.004169 | -0.327969 | 19.821705 |

| 4 | ExternalRiskEstimate | 4 | [67.5000, 70.5000) | 1038 | 0.099245 | 388 | 650 | 0.626204 | -0.428139 | 0.017755 | 0.002203 | -0.327969 | 25.498720 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 8 | PercentTradesWBalance | 8 | [80.5000, 87.5000) | 797 | 0.076202 | 283 | 514 | 0.644918 | -0.508949 | 0.019114 | 0.002364 | -0.016322 | 32.310289 |

| 9 | PercentTradesWBalance | 9 | [87.5000, 98.0000) | 652 | 0.062339 | 184 | 468 | 0.717791 | -0.845705 | 0.041380 | 0.005024 | -0.016322 | 32.026880 |

| 10 | PercentTradesWBalance | 10 | [98.0000, inf) | 1277 | 0.122096 | 331 | 946 | 0.740799 | -0.962296 | 0.103054 | 0.012407 | -0.016322 | 31.928758 |

| 11 | PercentTradesWBalance | 11 | Special | 606 | 0.057941 | 269 | 337 | 0.556106 | -0.137544 | 0.001091 | 0.000136 | -0.016322 | 32.738612 |

| 12 | PercentTradesWBalance | 12 | Missing | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | -0.016322 | 32.738612 |

164 rows × 13 columns

We can check the correctness of the scaling method as follows

[16]:

sc = scorecard.table(style="summary")

sc.groupby("Variable").agg({'Points' : [np.min, np.max]}).sum()

[16]:

Points amin 300.0

amax 850.0

dtype: float64

Scorecard performance¶

Compute predicted probabilities of the fitted estimator.

[17]:

y_pred = scorecard.predict_proba(X)[:, 1]

/home/gui/projects/github/top/optbinning/optbinning/binning/transformations.py:38: RuntimeWarning: invalid value encountered in log

return np.log((1. / event_rate - 1) * n_event / n_nonevent)

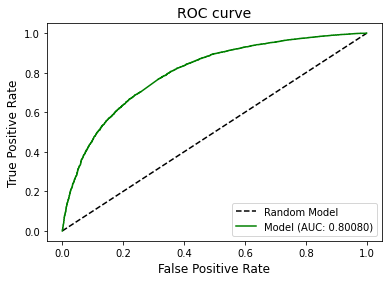

Plot Area Under the Receiver Operating Characteristic Curve (AUC ROC).

[18]:

plot_auc_roc(y, y_pred)

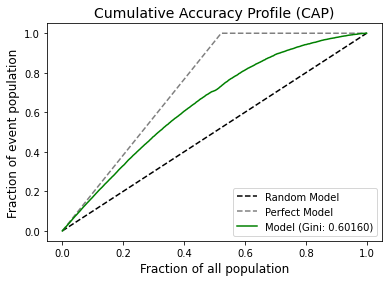

Plot Cumulative Accuracy Profile (CAP).

[19]:

plot_cap(y, y_pred)

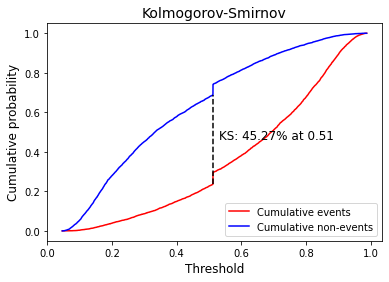

Plot Kolmogorov-Smirnov (KS).

[20]:

plot_ks(y, y_pred)

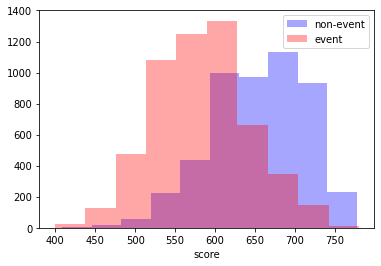

Calculate the score of the dataset and plot distribution of scores for event and non-event records.

[21]:

score = scorecard.score(X)

[22]:

mask = y == 0

plt.hist(score[mask], label="non-event", color="b", alpha=0.35)

plt.hist(score[~mask], label="event", color="r", alpha=0.35)

plt.xlabel("score")

plt.legend()

plt.show()