Tutorial: optimal binning with binary target under uncertainty¶

The drawback of performing optimal binning given only expected event rates is that variability of event rates in different periods is not taken into account. In this tutorial, we show how scenario-based stochastic programming allows incorporating uncertainty without much difficulty.

[1]:

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

from scipy import stats

[2]:

from optbinning import OptimalBinning

from optbinning.binning.uncertainty import SBOptimalBinning

Scenario generation¶

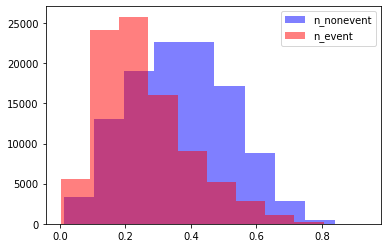

We generate three scenarios, all equally likely, aiming to represent three economic scenarios severity using the customer’s score variable, for instance.

Scenario 0 - Normal (Realistic): A low customer’ score has a higher event rate (default rate, churn, etc) than a high customer’s score. The population corresponding to non-event and event are reasonably separated.

[3]:

N0 = int(1e5)

xe = stats.beta(a=4, b=15).rvs(size=N0, random_state=42)

ye = stats.bernoulli(p=0.7).rvs(size=N0, random_state=42)

xn = stats.beta(a=6, b=8).rvs(size=N0, random_state=42)

yn = stats.bernoulli(p=0.2).rvs(size=N0, random_state=42)

x0 = np.concatenate((xn, xe), axis=0)

y0 = np.concatenate((yn, ye), axis=0)

[4]:

def plot_distribution(x, y):

plt.hist(x[y == 0], label="n_nonevent", color="b", alpha=0.5)

plt.hist(x[y == 1], label="n_event", color="r", alpha=0.5)

plt.legend()

plt.show()

[5]:

plot_distribution(x0, y0)

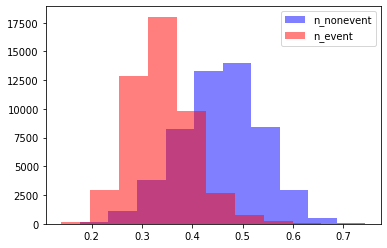

Scenario 1: Good (Optimistic): A low customer’ score has a much higher event rate (default rate, churn, etc) than a high customer’s score. The population corresponding to non-event and event rate are very well separated, showing minimum overlap regions.

[6]:

N1 = int(5e4)

xe = stats.beta(a=25, b=50).rvs(size=N1, random_state=42)

ye = stats.bernoulli(p=0.9).rvs(size=N1, random_state=42)

xn = stats.beta(a=22, b=25).rvs(size=N1, random_state=42)

yn = stats.bernoulli(p=0.05).rvs(size=N1, random_state=42)

x1 = np.concatenate((xn, xe), axis=0)

y1 = np.concatenate((yn, ye), axis=0)

[7]:

plot_distribution(x1, y1)

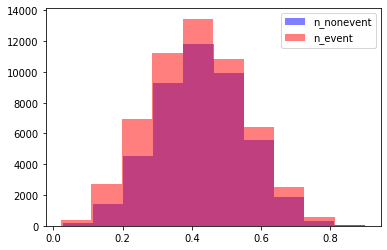

Scenario 2: Bad (Pessimistic): Customer’s behavior cannot be accurately segmented, and a general increase in event rates is exhibited. The populations corresponding to non-event and event are practically overlapped.

[8]:

N2 = int(5e4)

xe = stats.beta(a=4, b=6).rvs(size=N2, random_state=42)

ye = stats.bernoulli(p=0.7).rvs(size=N2, random_state=42)

xn = stats.beta(a=8, b=10).rvs(size=N2, random_state=42)

yn = stats.bernoulli(p=0.4).rvs(size=N2, random_state=42)

x2 = np.concatenate((xn, xe), axis=0)

y2 = np.concatenate((yn, ye), axis=0)

[9]:

plot_distribution(x2, y2)

Scenario-based stochastic optimal binning¶

Prepare scenarios data and instantiate an SBOptimalBinning object class. We set a descending monotonicity constraint with respect to event rate and a minimum bin size.

[10]:

X = [x0, x1, x2]

Y = [y0, y1, y2]

[11]:

sboptb = SBOptimalBinning(monotonic_trend="descending", min_bin_size=0.05)

sboptb.fit(X, Y)

[11]:

SBOptimalBinning(min_bin_size=0.05, monotonic_trend='descending')

[12]:

sboptb.status

[12]:

'OPTIMAL'

We obtain “only” three splits guaranteeing feasibility for each scenario.

[13]:

sboptb.splits

[13]:

array([0.28578988, 0.36384453, 0.43260857])

[14]:

sboptb.information(print_level=2)

optbinning (Version 0.19.0)

Copyright (c) 2019-2024 Guillermo Navas-Palencia, Apache License 2.0

Begin options

name * d

prebinning_method cart * d

max_n_prebins 20 * d

min_prebin_size 0.05 * d

min_n_bins no * d

max_n_bins no * d

min_bin_size 0.05 * U

max_bin_size no * d

monotonic_trend descending * U

min_event_rate_diff 0 * d

max_pvalue no * d

max_pvalue_policy consecutive * d

class_weight no * d

user_splits no * d

user_splits_fixed no * d

special_codes no * d

split_digits no * d

time_limit 100 * d

verbose False * d

End options

Name : UNKNOWN

Status : OPTIMAL

Pre-binning statistics

Number of pre-bins 16

Number of refinements 1

Solver statistics

Type cp

Number of booleans 40

Number of branches 91

Number of conflicts 1

Objective value 2736534

Best objective bound 2736534

Timing

Total time 1.21 sec

Pre-processing 0.01 sec ( 0.90%)

Pre-binning 0.70 sec ( 58.18%)

Solver 0.49 sec ( 40.72%)

model generation 0.44 sec ( 90.22%)

optimizer 0.05 sec ( 9.78%)

Post-processing 0.00 sec ( 0.10%)

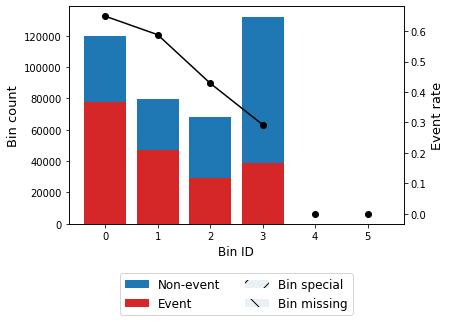

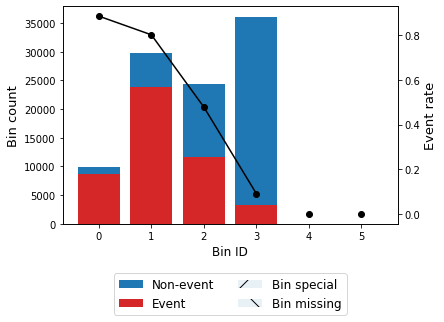

The binning table¶

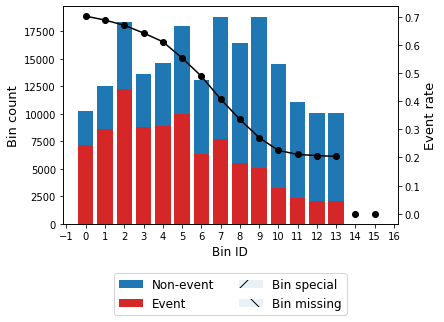

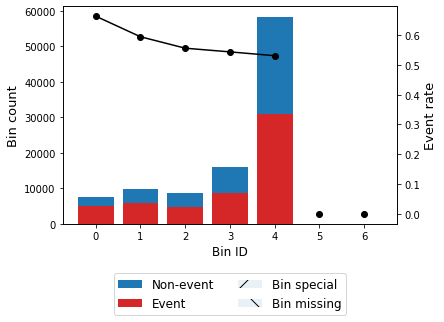

As other optimal binning algorithms in OptBinning, SBOptimalBinning also returns a binning table displaying the binned data considering all scenarios.

[15]:

sboptb.binning_table.build()

[15]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.29) | 119678 | 0.299195 | 42005 | 77673 | 0.649017 | -0.688603 | 0.138209 | 0.016943 |

| 1 | [0.29, 0.36) | 79729 | 0.199323 | 32837 | 46892 | 0.588142 | -0.430175 | 0.036613 | 0.004542 |

| 2 | [0.36, 0.43) | 68378 | 0.170945 | 39045 | 29333 | 0.428983 | 0.212118 | 0.007633 | 0.000952 |

| 3 | [0.43, inf) | 132215 | 0.330537 | 93498 | 38717 | 0.292834 | 0.807778 | 0.201811 | 0.024562 |

| 4 | Special | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 5 | Missing | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 400000 | 1.000000 | 207385 | 192615 | 0.481538 | 0.384266 | 0.046999 |

[16]:

sboptb.binning_table.plot(metric="event_rate")

[17]:

sboptb.binning_table.analysis()

---------------------------------------------

OptimalBinning: Binary Binning Table Analysis

---------------------------------------------

General metrics

Gini index 0.33117510

IV (Jeffrey) 0.38426602

JS (Jensen-Shannon) 0.04699884

Hellinger 0.04750871

Triangular 0.18408357

KS 0.28582022

HHI 0.26772434

HHI (normalized) 0.12126921

Cramer's V 0.30285954

Quality score 0.87798527

Monotonic trend descending

Significance tests

Bin A Bin B t-statistic p-value P[A > B] P[B > A]

0 1 756.303469 1.709260e-166 1.0 1.110223e-16

1 2 3732.973381 0.000000e+00 1.0 1.110223e-16

2 3 3726.998391 0.000000e+00 1.0 1.110223e-16

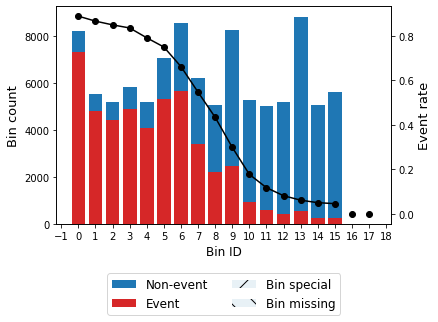

Expected value solution (EVS)¶

The expected value solution is calculated with the normal (expected) scenario.

[18]:

optb = OptimalBinning(monotonic_trend="descending", min_bin_size=0.05)

optb.fit(x0, y0)

[18]:

OptimalBinning(min_bin_size=0.05, monotonic_trend='descending')

[19]:

optb.binning_table.build()

[19]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.10) | 10255 | 0.051275 | 3061 | 7194 | 0.701511 | -1.054853 | 0.054945 | 0.006566 |

| 1 | [0.10, 0.14) | 12519 | 0.062595 | 3911 | 8608 | 0.687595 | -0.989246 | 0.059422 | 0.007139 |

| 2 | [0.14, 0.18) | 18333 | 0.091665 | 6065 | 12268 | 0.669176 | -0.904807 | 0.073418 | 0.008877 |

| 3 | [0.18, 0.20) | 13631 | 0.068155 | 4884 | 8747 | 0.641699 | -0.783094 | 0.041320 | 0.005037 |

| 4 | [0.20, 0.23) | 14606 | 0.073030 | 5684 | 8922 | 0.610845 | -0.651212 | 0.030891 | 0.003795 |

| 5 | [0.23, 0.27) | 17995 | 0.089975 | 8043 | 9952 | 0.553043 | -0.413319 | 0.015470 | 0.001920 |

| 6 | [0.27, 0.30) | 13047 | 0.065235 | 6672 | 6375 | 0.488618 | -0.154812 | 0.001572 | 0.000196 |

| 7 | [0.30, 0.35) | 18825 | 0.094125 | 11158 | 7667 | 0.407278 | 0.174884 | 0.002847 | 0.000355 |

| 8 | [0.35, 0.39) | 16401 | 0.082005 | 10903 | 5498 | 0.335223 | 0.484306 | 0.018430 | 0.002282 |

| 9 | [0.39, 0.44) | 18759 | 0.093795 | 13688 | 5071 | 0.270324 | 0.792634 | 0.053994 | 0.006578 |

| 10 | [0.44, 0.49) | 14549 | 0.072745 | 11273 | 3276 | 0.225170 | 1.035440 | 0.068446 | 0.008193 |

| 11 | [0.49, 0.54) | 11019 | 0.055095 | 8697 | 2322 | 0.210727 | 1.120202 | 0.059684 | 0.007093 |

| 12 | [0.54, 0.60) | 10030 | 0.050150 | 7957 | 2073 | 0.206680 | 1.144708 | 0.056454 | 0.006695 |

| 13 | [0.60, inf) | 10031 | 0.050155 | 7988 | 2043 | 0.203669 | 1.163174 | 0.058080 | 0.006877 |

| 14 | Special | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 15 | Missing | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 200000 | 1.000000 | 109984 | 90016 | 0.450080 | 0.594974 | 0.071603 |

[20]:

optb.binning_table.plot(metric="event_rate")

[21]:

optb.binning_table.analysis()

---------------------------------------------

OptimalBinning: Binary Binning Table Analysis

---------------------------------------------

General metrics

Gini index 0.42141055

IV (Jeffrey) 0.59497411

JS (Jensen-Shannon) 0.07160267

Hellinger 0.07295186

Triangular 0.27638899

KS 0.34108533

HHI 0.07501900

HHI (normalized) 0.01335360

Cramer's V 0.36927482

Quality score 0.16335319

Monotonic trend descending

Significance tests

Bin A Bin B t-statistic p-value P[A > B] P[B > A]

0 1 5.139745 2.338408e-02 0.988706 1.129409e-02

1 2 11.534993 6.829832e-04 0.999721 2.787731e-04

2 3 26.208899 3.064073e-07 1.000000 7.445353e-09

3 4 28.661681 8.619251e-08 1.000000 4.436704e-09

4 5 110.500800 7.611468e-26 1.000000 1.110223e-16

5 6 125.906119 3.223792e-29 1.000000 1.110223e-16

6 7 206.865709 6.632897e-47 1.000000 1.110223e-16

7 8 194.419542 3.449032e-44 1.000000 1.110223e-16

8 9 175.309976 5.122903e-40 1.000000 1.110223e-16

9 10 88.957203 4.034468e-21 1.000000 1.110223e-16

10 11 7.648694 5.681344e-03 0.997558 2.442113e-03

11 12 0.520543 4.706103e-01 0.764881 2.351195e-01

12 13 0.278879 5.974371e-01 0.701329 2.986709e-01

Scenario analysis¶

Scenario 0 - Normal (Realistic)¶

[22]:

bt0 = sboptb.binning_table_scenario(scenario_id=0)

bt0.build()

[22]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.29) | 93851 | 0.469255 | 34903 | 58948 | 0.628102 | -0.724430 | 0.244506 | 0.029912 |

| 1 | [0.29, 0.36) | 32141 | 0.160705 | 18945 | 13196 | 0.410566 | 0.161279 | 0.004138 | 0.000517 |

| 2 | [0.36, 0.43) | 24488 | 0.122440 | 17289 | 7199 | 0.293981 | 0.675781 | 0.052184 | 0.006402 |

| 3 | [0.43, inf) | 49520 | 0.247600 | 38847 | 10673 | 0.215529 | 1.091566 | 0.256123 | 0.030515 |

| 4 | Special | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 5 | Missing | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 200000 | 1.000000 | 109984 | 90016 | 0.450080 | 0.556952 | 0.067345 |

[23]:

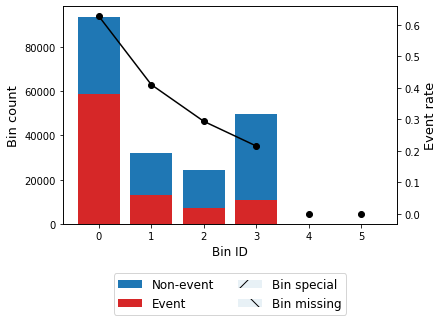

bt0.plot(metric="event_rate")

[24]:

optb0 = OptimalBinning(monotonic_trend="descending", min_bin_size=0.05)

optb0.fit(x0, y0)

[24]:

OptimalBinning(min_bin_size=0.05, monotonic_trend='descending')

[25]:

optb0.binning_table.build()

[25]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.10) | 10255 | 0.051275 | 3061 | 7194 | 0.701511 | -1.054853 | 0.054945 | 0.006566 |

| 1 | [0.10, 0.14) | 12519 | 0.062595 | 3911 | 8608 | 0.687595 | -0.989246 | 0.059422 | 0.007139 |

| 2 | [0.14, 0.18) | 18333 | 0.091665 | 6065 | 12268 | 0.669176 | -0.904807 | 0.073418 | 0.008877 |

| 3 | [0.18, 0.20) | 13631 | 0.068155 | 4884 | 8747 | 0.641699 | -0.783094 | 0.041320 | 0.005037 |

| 4 | [0.20, 0.23) | 14606 | 0.073030 | 5684 | 8922 | 0.610845 | -0.651212 | 0.030891 | 0.003795 |

| 5 | [0.23, 0.27) | 17995 | 0.089975 | 8043 | 9952 | 0.553043 | -0.413319 | 0.015470 | 0.001920 |

| 6 | [0.27, 0.30) | 13047 | 0.065235 | 6672 | 6375 | 0.488618 | -0.154812 | 0.001572 | 0.000196 |

| 7 | [0.30, 0.35) | 18825 | 0.094125 | 11158 | 7667 | 0.407278 | 0.174884 | 0.002847 | 0.000355 |

| 8 | [0.35, 0.39) | 16401 | 0.082005 | 10903 | 5498 | 0.335223 | 0.484306 | 0.018430 | 0.002282 |

| 9 | [0.39, 0.44) | 18759 | 0.093795 | 13688 | 5071 | 0.270324 | 0.792634 | 0.053994 | 0.006578 |

| 10 | [0.44, 0.49) | 14549 | 0.072745 | 11273 | 3276 | 0.225170 | 1.035440 | 0.068446 | 0.008193 |

| 11 | [0.49, 0.54) | 11019 | 0.055095 | 8697 | 2322 | 0.210727 | 1.120202 | 0.059684 | 0.007093 |

| 12 | [0.54, 0.60) | 10030 | 0.050150 | 7957 | 2073 | 0.206680 | 1.144708 | 0.056454 | 0.006695 |

| 13 | [0.60, inf) | 10031 | 0.050155 | 7988 | 2043 | 0.203669 | 1.163174 | 0.058080 | 0.006877 |

| 14 | Special | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 15 | Missing | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 200000 | 1.000000 | 109984 | 90016 | 0.450080 | 0.594974 | 0.071603 |

[26]:

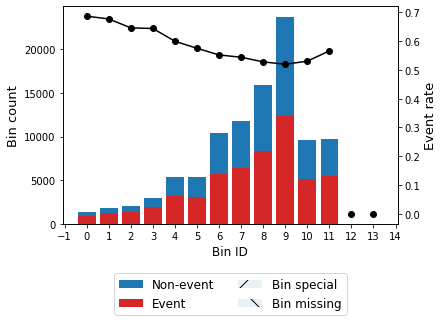

optb0.binning_table.plot(metric="event_rate")

Apply expected value solution to scenario 0.

[27]:

evs_optb0 = OptimalBinning(user_splits=optb.splits)

evs_optb0.fit(x0, y0)

[27]:

OptimalBinning(user_splits=array([0.1008646 , 0.13640077, 0.17635711, 0.20390539, 0.23334569,

0.27135116, 0.30051835, 0.34623086, 0.38964605, 0.44464479,

0.49356021, 0.53990114, 0.59801421]))

[28]:

evs_optb0.binning_table.build()

[28]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.10) | 10255 | 0.051275 | 3061 | 7194 | 0.701511 | -1.054853 | 0.054945 | 0.006566 |

| 1 | [0.10, 0.14) | 12519 | 0.062595 | 3911 | 8608 | 0.687595 | -0.989246 | 0.059422 | 0.007139 |

| 2 | [0.14, 0.18) | 18333 | 0.091665 | 6065 | 12268 | 0.669176 | -0.904807 | 0.073418 | 0.008877 |

| 3 | [0.18, 0.20) | 13631 | 0.068155 | 4884 | 8747 | 0.641699 | -0.783094 | 0.041320 | 0.005037 |

| 4 | [0.20, 0.23) | 14606 | 0.073030 | 5684 | 8922 | 0.610845 | -0.651212 | 0.030891 | 0.003795 |

| 5 | [0.23, 0.27) | 17995 | 0.089975 | 8043 | 9952 | 0.553043 | -0.413319 | 0.015470 | 0.001920 |

| 6 | [0.27, 0.30) | 13047 | 0.065235 | 6672 | 6375 | 0.488618 | -0.154812 | 0.001572 | 0.000196 |

| 7 | [0.30, 0.35) | 18825 | 0.094125 | 11158 | 7667 | 0.407278 | 0.174884 | 0.002847 | 0.000355 |

| 8 | [0.35, 0.39) | 16401 | 0.082005 | 10903 | 5498 | 0.335223 | 0.484306 | 0.018430 | 0.002282 |

| 9 | [0.39, 0.44) | 18759 | 0.093795 | 13688 | 5071 | 0.270324 | 0.792634 | 0.053994 | 0.006578 |

| 10 | [0.44, 0.49) | 14549 | 0.072745 | 11273 | 3276 | 0.225170 | 1.035440 | 0.068446 | 0.008193 |

| 11 | [0.49, 0.54) | 11019 | 0.055095 | 8697 | 2322 | 0.210727 | 1.120202 | 0.059684 | 0.007093 |

| 12 | [0.54, 0.60) | 10030 | 0.050150 | 7957 | 2073 | 0.206680 | 1.144708 | 0.056454 | 0.006695 |

| 13 | [0.60, inf) | 10031 | 0.050155 | 7988 | 2043 | 0.203669 | 1.163174 | 0.058080 | 0.006877 |

| 14 | Special | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 15 | Missing | 0 | 0.000000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 200000 | 1.000000 | 109984 | 90016 | 0.450080 | 0.594974 | 0.071603 |

[29]:

evs_optb0.binning_table.plot(metric="event_rate")

The expected value solution applied to scenarion 0 does not satisfy the min_bin_size constraint, hence the solution is not feasible.

[30]:

EVS_0 = 0.594974

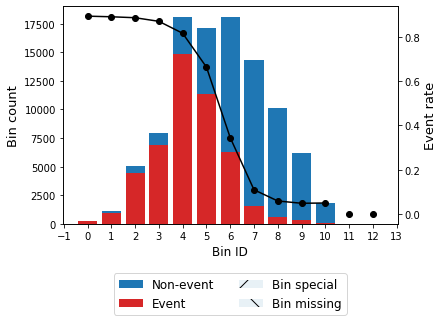

Scenario 1: Good (Optimistic)

[31]:

bt1 = sboptb.binning_table_scenario(scenario_id=1)

bt1.build()

[31]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.29) | 9840 | 0.09840 | 1126 | 8714 | 0.885569 | -2.146624 | 0.347828 | 0.036679 |

| 1 | [0.29, 0.36) | 29807 | 0.29807 | 5902 | 23905 | 0.801993 | -1.499161 | 0.586072 | 0.067087 |

| 2 | [0.36, 0.43) | 24262 | 0.24262 | 12658 | 11604 | 0.478279 | -0.013425 | 0.000044 | 0.000005 |

| 3 | [0.43, inf) | 36091 | 0.36091 | 32821 | 3270 | 0.090604 | 2.205914 | 1.226988 | 0.128301 |

| 4 | Special | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 5 | Missing | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 100000 | 1.00000 | 52507 | 47493 | 0.474930 | 2.160931 | 0.232072 |

[32]:

bt1.plot(metric="event_rate")

[33]:

optb1 = OptimalBinning(monotonic_trend="descending", min_bin_size=0.05)

optb1.fit(x1, y1)

[33]:

OptimalBinning(min_bin_size=0.05, monotonic_trend='descending')

[34]:

optb1.binning_table.build()

[34]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.28) | 8209 | 0.08209 | 908 | 7301 | 0.889390 | -2.184886 | 0.298095 | 0.031264 |

| 1 | [0.28, 0.30) | 5545 | 0.05545 | 738 | 4807 | 0.866907 | -1.974249 | 0.172075 | 0.018581 |

| 2 | [0.30, 0.31) | 5186 | 0.05186 | 777 | 4409 | 0.850174 | -1.836327 | 0.143301 | 0.015756 |

| 3 | [0.31, 0.33) | 5837 | 0.05837 | 956 | 4881 | 0.836217 | -1.730712 | 0.146359 | 0.016307 |

| 4 | [0.33, 0.34) | 5176 | 0.05176 | 1077 | 4099 | 0.791924 | -1.436928 | 0.094544 | 0.010896 |

| 5 | [0.34, 0.36) | 7055 | 0.07055 | 1760 | 5295 | 0.750532 | -1.201813 | 0.093706 | 0.011056 |

| 6 | [0.36, 0.38) | 8537 | 0.08537 | 2882 | 5655 | 0.662411 | -0.774420 | 0.049704 | 0.006062 |

| 7 | [0.38, 0.40) | 6189 | 0.06189 | 2802 | 3387 | 0.547261 | -0.289975 | 0.005205 | 0.000648 |

| 8 | [0.40, 0.41) | 5058 | 0.05058 | 2862 | 2196 | 0.434164 | 0.164519 | 0.001360 | 0.000170 |

| 9 | [0.41, 0.44) | 8246 | 0.08246 | 5781 | 2465 | 0.298933 | 0.752021 | 0.043766 | 0.005345 |

| 10 | [0.44, 0.45) | 5253 | 0.05253 | 4321 | 932 | 0.177422 | 1.433545 | 0.089840 | 0.010358 |

| 11 | [0.45, 0.47) | 5009 | 0.05009 | 4420 | 589 | 0.117588 | 1.915105 | 0.137461 | 0.014960 |

| 12 | [0.47, 0.49) | 5204 | 0.05204 | 4780 | 424 | 0.081476 | 2.322098 | 0.190662 | 0.019603 |

| 13 | [0.49, 0.53) | 8825 | 0.08825 | 8283 | 542 | 0.061416 | 2.626330 | 0.384332 | 0.037733 |

| 14 | [0.53, 0.56) | 5061 | 0.05061 | 4807 | 254 | 0.050188 | 2.840130 | 0.244824 | 0.023237 |

| 15 | [0.56, inf) | 5610 | 0.05610 | 5353 | 257 | 0.045811 | 2.935972 | 0.283430 | 0.026488 |

| 16 | Special | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 17 | Missing | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 100000 | 1.00000 | 52507 | 47493 | 0.474930 | 2.378665 | 0.248465 |

[35]:

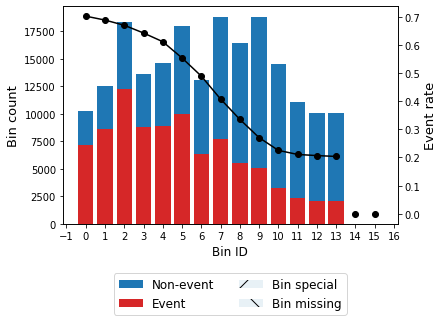

optb1.binning_table.plot(metric="event_rate")

Apply expected value solution to scenario 1.

[36]:

evs_optb1 = OptimalBinning(user_splits=optb.splits)

evs_optb1.fit(x1, y1)

[36]:

OptimalBinning(user_splits=array([0.1008646 , 0.13640077, 0.17635711, 0.20390539, 0.23334569,

0.27135116, 0.30051835, 0.34623086, 0.38964605, 0.44464479,

0.49356021, 0.53990114, 0.59801421]))

[37]:

evs_optb1.binning_table.build()

[37]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.20) | 247 | 0.00247 | 26 | 221 | 0.894737 | -2.240430 | 0.009316 | 0.000969 |

| 1 | [0.20, 0.23) | 1092 | 0.01092 | 118 | 974 | 0.891941 | -2.211091 | 0.040377 | 0.004219 |

| 2 | [0.23, 0.27) | 5037 | 0.05037 | 566 | 4471 | 0.887632 | -2.167137 | 0.180654 | 0.018995 |

| 3 | [0.27, 0.30) | 7918 | 0.07918 | 1019 | 6899 | 0.871306 | -2.012919 | 0.253339 | 0.027214 |

| 4 | [0.30, 0.35) | 18126 | 0.18126 | 3313 | 14813 | 0.817224 | -1.598015 | 0.397590 | 0.045005 |

| 5 | [0.35, 0.39) | 17091 | 0.17091 | 5742 | 11349 | 0.664034 | -0.781686 | 0.101310 | 0.012351 |

| 6 | [0.39, 0.44) | 18095 | 0.18095 | 11857 | 6238 | 0.344736 | 0.541895 | 0.051194 | 0.006322 |

| 7 | [0.44, 0.49) | 14295 | 0.14295 | 12739 | 1556 | 0.108849 | 2.002186 | 0.420164 | 0.045199 |

| 8 | [0.49, 0.54) | 10111 | 0.10111 | 9523 | 588 | 0.058154 | 2.684374 | 0.453620 | 0.044133 |

| 9 | [0.54, 0.60) | 6215 | 0.06215 | 5918 | 297 | 0.047788 | 2.891658 | 0.307832 | 0.028976 |

| 10 | [0.60, inf) | 1773 | 0.01773 | 1686 | 87 | 0.049069 | 2.863842 | 0.086712 | 0.008199 |

| 11 | Special | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 12 | Missing | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 100000 | 1.00000 | 52507 | 47493 | 0.474930 | 2.302108 | 0.241582 |

[38]:

evs_optb1.binning_table.plot(metric="event_rate")

[39]:

evs_optb1.binning_table.analysis()

---------------------------------------------

OptimalBinning: Binary Binning Table Analysis

---------------------------------------------

General metrics

Gini index 0.72566718

IV (Jeffrey) 2.30210757

JS (Jensen-Shannon) 0.24158211

Hellinger 0.26182242

Triangular 0.84830395

KS 0.61004329

HHI 0.13857518

HHI (normalized) 0.06678978

Cramer's V 0.64902999

Quality score 0.00000000

Monotonic trend valley

Significance tests

Bin A Bin B t-statistic p-value P[A > B] P[B > A]

0 1 0.016401 8.980961e-01 0.566231 4.337689e-01

1 2 0.168135 6.817748e-01 0.666387 3.336129e-01

2 3 7.641448 5.704212e-03 0.997457 2.543322e-03

3 4 116.236493 4.218674e-27 1.000000 1.110223e-16

4 5 1080.747496 5.050568e-237 1.000000 1.110223e-16

5 6 3584.325798 0.000000e+00 1.000000 1.110223e-16

6 7 2431.847481 0.000000e+00 1.000000 1.110223e-16

7 8 189.938108 3.279750e-43 1.000000 1.110223e-16

8 9 8.068486 4.504174e-03 0.998346 1.654368e-03

9 10 0.049526 8.238907e-01 0.420232 5.797684e-01

The expected value solution applied to scenario 1 satisfies neither the min_bin_size constraint nor the monotonicity constraint, hence the solution is not feasible.

[40]:

EVS_1 = -np.inf

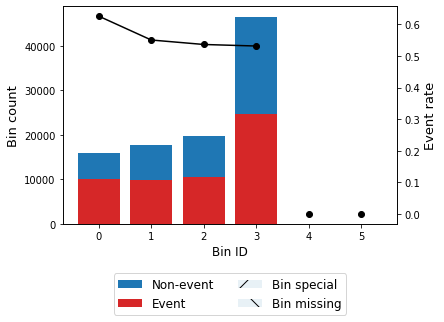

Scenario 2: Bad (Pessimistic)

[41]:

bt2 = sboptb.binning_table_scenario(scenario_id=2)

bt2.build()

[41]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.29) | 15987 | 0.15987 | 5976 | 10011 | 0.626196 | -0.310979 | 1.509941e-02 | 1.879858e-03 |

| 1 | [0.29, 0.36) | 17781 | 0.17781 | 7990 | 9791 | 0.550644 | 0.001682 | 5.028570e-07 | 6.285711e-08 |

| 2 | [0.36, 0.43) | 19628 | 0.19628 | 9098 | 10530 | 0.536479 | 0.058781 | 6.800268e-04 | 8.499112e-05 |

| 3 | [0.43, inf) | 46604 | 0.46604 | 21830 | 24774 | 0.531585 | 0.078445 | 2.877876e-03 | 3.596423e-04 |

| 4 | Special | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000e+00 | 0.000000e+00 |

| 5 | Missing | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000e+00 | 0.000000e+00 |

| Totals | 100000 | 1.00000 | 44894 | 55106 | 0.551060 | 1.865782e-02 | 2.324554e-03 |

[42]:

bt2.plot(metric="event_rate")

[43]:

optb2 = OptimalBinning(monotonic_trend="descending", min_bin_size=0.05)

optb2.fit(x2, y2)

[43]:

OptimalBinning(min_bin_size=0.05, monotonic_trend='descending')

[44]:

optb2.binning_table.build()

[44]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.23) | 7556 | 0.07556 | 2543 | 5013 | 0.663446 | -0.473736 | 0.016261 | 0.002014 |

| 1 | [0.23, 0.29) | 9657 | 0.09657 | 3918 | 5739 | 0.594284 | -0.176749 | 0.002982 | 0.000372 |

| 2 | [0.29, 0.33) | 8559 | 0.08559 | 3801 | 4758 | 0.555906 | -0.019609 | 0.000033 | 0.000004 |

| 3 | [0.33, 0.39) | 15848 | 0.15848 | 7234 | 8614 | 0.543539 | 0.030358 | 0.000146 | 0.000018 |

| 4 | [0.39, inf) | 58380 | 0.58380 | 27398 | 30982 | 0.530695 | 0.082018 | 0.003941 | 0.000493 |

| 5 | Special | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 6 | Missing | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Totals | 100000 | 1.00000 | 44894 | 55106 | 0.551060 | 0.023364 | 0.002901 |

[45]:

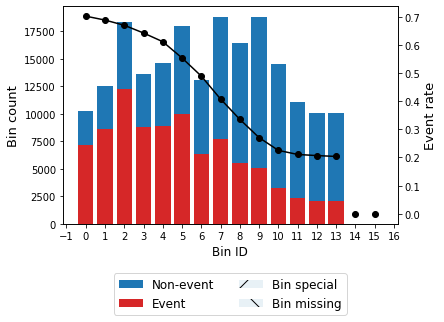

optb2.binning_table.plot(metric="event_rate")

Apply expected value solution to scenario 2.

[46]:

evs_optb2 = OptimalBinning(user_splits=optb.splits)

evs_optb2.fit(x2, y2)

[46]:

OptimalBinning(user_splits=array([0.1008646 , 0.13640077, 0.17635711, 0.20390539, 0.23334569,

0.27135116, 0.30051835, 0.34623086, 0.38964605, 0.44464479,

0.49356021, 0.53990114, 0.59801421]))

[47]:

evs_optb2.binning_table.build()

[47]:

| Bin | Count | Count (%) | Non-event | Event | Event rate | WoE | IV | JS | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | (-inf, 0.14) | 1292 | 0.01292 | 405 | 887 | 0.686533 | -0.579003 | 0.004096 | 5.050214e-04 |

| 1 | [0.14, 0.18) | 1850 | 0.01850 | 598 | 1252 | 0.676757 | -0.533952 | 0.005019 | 6.200181e-04 |

| 2 | [0.18, 0.20) | 2002 | 0.02002 | 709 | 1293 | 0.645854 | -0.395910 | 0.003037 | 3.771741e-04 |

| 3 | [0.20, 0.23) | 2944 | 0.02944 | 1049 | 1895 | 0.643682 | -0.386427 | 0.004259 | 5.291176e-04 |

| 4 | [0.23, 0.27) | 5326 | 0.05326 | 2134 | 3192 | 0.599324 | -0.197695 | 0.002054 | 2.563524e-04 |

| 5 | [0.27, 0.30) | 5390 | 0.05390 | 2291 | 3099 | 0.574954 | -0.097137 | 0.000506 | 6.318381e-05 |

| 6 | [0.30, 0.35) | 10414 | 0.10414 | 4667 | 5747 | 0.551853 | -0.003207 | 0.000001 | 1.338664e-07 |

| 7 | [0.35, 0.39) | 11782 | 0.11782 | 5375 | 6407 | 0.543796 | 0.029322 | 0.000101 | 1.267992e-05 |

| 8 | [0.39, 0.44) | 15901 | 0.15901 | 7509 | 8392 | 0.527766 | 0.093778 | 0.001404 | 1.754450e-04 |

| 9 | [0.44, 0.54) | 23757 | 0.23757 | 11416 | 12341 | 0.519468 | 0.127043 | 0.003854 | 4.814509e-04 |

| 10 | [0.54, 0.60) | 9639 | 0.09639 | 4529 | 5110 | 0.530138 | 0.084256 | 0.000687 | 8.582857e-05 |

| 11 | [0.60, inf) | 9703 | 0.09703 | 4212 | 5491 | 0.565907 | -0.060218 | 0.000351 | 4.382723e-05 |

| 12 | Special | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000e+00 |

| 13 | Missing | 0 | 0.00000 | 0 | 0 | 0.000000 | 0.000000 | 0.000000 | 0.000000e+00 |

| Totals | 100000 | 1.00000 | 44894 | 55106 | 0.551060 | 0.025370 | 3.150233e-03 |

[48]:

evs_optb2.binning_table.plot(metric="event_rate")

[49]:

evs_optb2.binning_table.analysis()

---------------------------------------------

OptimalBinning: Binary Binning Table Analysis

---------------------------------------------

General metrics

Gini index 0.07657686

IV (Jeffrey) 0.02536981

JS (Jensen-Shannon) 0.00315023

Hellinger 0.00316066

Triangular 0.01251904

KS 0.05109803

HHI 0.13267476

HHI (normalized) 0.06595743

Cramer's V 0.07812501

Quality score 0.00318975

Monotonic trend valley

Significance tests

Bin A Bin B t-statistic p-value P[A > B] P[B > A]

0 1 0.334525 5.630065e-01 7.193040e-01 0.280696

1 2 4.095897 4.298741e-02 9.789856e-01 0.021014

2 3 0.024540 8.755193e-01 5.627139e-01 0.437286

3 4 15.757594 7.199834e-05 9.999743e-01 0.000026

4 5 6.563219 1.041079e-02 9.951398e-01 0.004860

5 6 7.690930 5.549902e-03 9.973851e-01 0.002615

6 7 1.448735 2.287310e-01 8.858561e-01 0.114144

7 8 6.989473 8.199050e-03 9.961485e-01 0.003852

8 9 2.628779 1.049424e-01 9.478637e-01 0.052136

9 10 3.128995 7.691114e-02 3.817921e-02 0.961821

10 11 24.977930 5.799032e-07 4.353127e-08 1.000000

The expected value solution applied to scenario 2 satisfies neither the min_bin_size constraint nor the monotonicity constraint, hence the solution is not feasible.

[50]:

EVS_2 = -np.inf

Expected value of perfect information (EVPI)¶

If we have prior information about the incoming economic scenarios, we could take optimal solutions for each scenario, with total IV:

[51]:

DIV0 = optb0.binning_table.iv

DIV1 = optb1.binning_table.iv

DIV2 = optb2.binning_table.iv

DIV = (DIV0 + DIV1 + DIV2) / 3

[52]:

DIV

[52]:

0.9990011753826167

However, this information is unlikely to be available in advance, so the best we can do in the long run is to use the stochastic programming, with expected total IV:

[53]:

SIV = sboptb.binning_table.iv

[54]:

SIV

[54]:

0.38426601503532376

The difference, in the case of perfect information, is the expected value of perfect information (EVPI) given by:

[55]:

EVPI = DIV - SIV

EVPI

[55]:

0.6147351603472929

Value of stochastic solution (VSS)¶

The loss in IV by not considering stochasticity is the difference between the application of the expected value solution for each scenario and the stochastic model IV. The application of the EVS to each scenario results in infeasible solutions, thus

[56]:

VSS = SIV - (EVS_0 + EVS_1 + EVS_2)

VSS

[56]:

inf